Given that Va loans can still keeps apparently higher closing costs, of numerous experts as well as their family end loans Blue Springs asking: will we just move these will cost you to your complete Va mortgage to minimize the dollars due in the closing?

Basically, not really. Based on a file written by the brand new Department from Seasoned Circumstances Va Local Financing Center, the sole closure charge you normally move to your good Virtual assistant loan number is the Virtual assistant financial support commission. Other closure costs have to be paid off during closing by you, the buyer.

Such as, when it is a consumer’s sector or you if you don’t enjoys influence, you might be able to discuss to the vendor to pay for a few of your own settlement costs. Just like the Virtual assistant hats supplier concessions in the 4% of the home amount borrowed, which could however add up to possibly more $ten,000 from inside the dollars discounts.

Do Virtual assistant money require financial insurance policies?

By comparison, that have a conventional loan, people who generate a down payment below 20% will need to pay for private mortgage insurance coverage (PMI) and that protects the financial institution in the event you default in your home loan. Generally, you can spend PMI once the a monthly superior.

Exactly who should get an excellent Va mortgage?

Anyone who qualifies having an effective Va financing will be at the very least consider it as an option, because Virtual assistant funds have extremely competitive prices and you can words having really absolutely nothing downside.

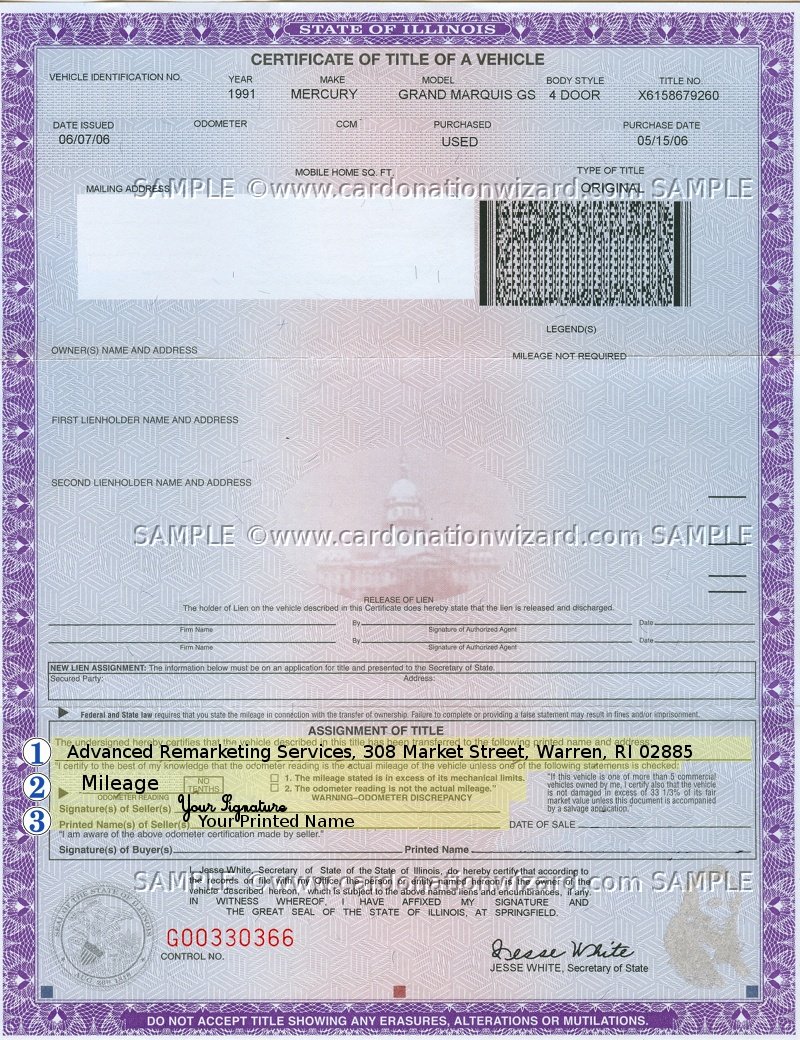

To help you qualify for a beneficial Virtual assistant loan, you need to earliest obtain a certification away from Qualifications (COE) regarding Virtual assistant itself. Generally, latest services players that served 90 concurrent days toward effective duty meet the requirements, because are veterans exactly who supported at least ninety days during wartime or 181 months throughout peacetime. Handicapped experts, thriving spouses, and you will National Guard and you can Set-aside players may also meet the requirements-understand the done selection of COE qualification criteria here.

Next, you ought to qualify given that a borrower. Virtual assistant loans don’t possess the very least credit rating criteria but loan providers manage, and also for them, this is usually around 620 (while some such as for example Skyrocket Financial make it fico scores as little as 580 having Virtual assistant fund). you will need an obligations-to-earnings (DTI) proportion away from 41% or lower.

In the long run, you need to be ready to move around in. The latest Va just makes you remove a good Va financing for the top house-not one minute, travel otherwise local rental assets. You also have to move during the contained in this good sensible time, along with vintage military manner, the new Va offers an exact definition of reasonable just like the within this 60 days, unless you normally approve a later date within this 12 months

Very so you can review, you ought to no less than imagine an effective Va loan for many who satisfy most of the requisite certificates: a beneficial COE, 620+ credit history, 41% otherwise down DTI and you are clearly ready to disperse.

Benefits and drawbacks from Virtual assistant finance

When you are Va financing are certainly one of the most attractive house fund on the market, it have lesser drawbacks and caveats to look at.

I’ve purchased a property using an excellent Virtual assistant financing and you will noticed much from someone else look at the processes, Alex, a dynamic-obligations You.S. Heavens Push master, informed Fortune Advises. The genuine financing techniques are fairly quick-akin to a conventional financing-as well as the lack of down-payment is amicable to younger provider players to own who 20% might possibly be a good year’s paycheck or higher. Along with, the greater number of strict evaluation requirements gave me support since the a beneficial (then) first-time homebuyer.

Was Va money widely ideal? We quite often state it depends,’ the guy explained. They continue to have their downsides-0% down function you will have limited equity for a long period, and you may Va check standards suggest you can’t get good fixer higher which have a beneficial Va loan. Otherwise, it unlock doorways in order to young military household who may well not if you don’t meet the requirements.