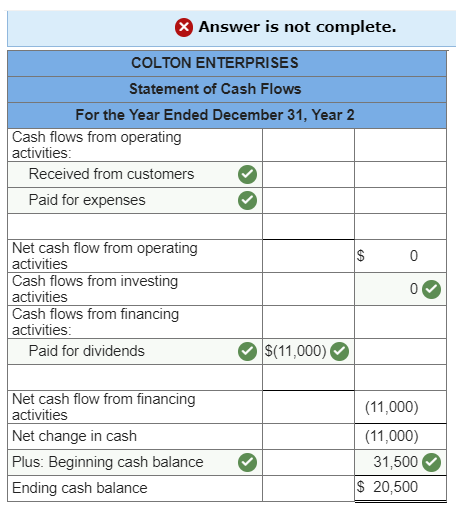

- Household equity financing: 8.5% repaired price, 15-season title, $494 payment

- 401(k) loan: 9.5% repaired speed, 5-12 months term, $step 1,049 payment per month

not, new 401(k) loan is smaller in terms of complete focus paid, charging $a dozen,940 in the desire repayments versus $38,920 towards the house security loan.

Additional factors to take on

- HELOCs and you will household equity finance wanted homeownership and you can adequate home collateral.

- Good credit (constantly 680-700 or more) is generally called for.

- 401(k) finance is going to be a last lodge, put only if other sensible choices aren’t offered.

- Demand a monetary mentor to check on your unique condition and you can mention all the mortgage solutions before making a decision.

Eventually, while you are 401(k) finance also have quick access to money, HELOCs and you will household security loans have a tendency to bring more good terms and you can dont sacrifice your retirement security.

Yet not, you will find really only one condition where borrowing out of your 401(k) is sensible. That will be for those who have a significant importance of dollars and you can simply no other way to access it affordably. Possibly your credit score is just too low or you actually have so many established bills to track down a different type of mortgage.

If you absolutely need to use from your own 401(k), be certain that not to borrow over what is called for. And then try to pay it off as fast as you could so you’re able to resume and come up with places and you can taking advantage of their employers’ matching program (in the event the available).

Choice loan alternatives

When you are weigh good HELOC against 401(k) mortgage or evaluating a 401(k) loan or household equity loan because of concerns about risking the house equity or advancing years savings, you could examine these choice borrowing options:

- Cash-away re-finance:Cash-out refinancing involves substitution your current financial with a brand new you to who’s a high amount borrowed. The essential difference between the newest financing along with your old home loan is gotten because the a lump sum cash payout. This enables you to tap into your property equity if you’re possibly protecting a lowered interest rate and extending the new fees several months. But not, it involves origination charges and you may settlement costs and might reset the new terms of your financial.

- Personal loans: Unsecured loans are unsecured http://www.elitecashadvance.com/installment-loans-ks/hamilton loans which can be used for different intentions, including debt consolidation otherwise home improvements. He or she is usually predicated on your creditworthiness and money in the place of your house security. Signature loans offer fixed prices and you can predictable monthly premiums more than a great given label. Because they may have large interest levels compared to the domestic guarantee choice, they will not place your household at risk.

- Playing cards: Playing cards are used for faster costs, nevertheless they tend to have large interest rates versus almost every other financing solutions. If you are considering having fun with handmade cards having debt consolidation reduction otherwise home advancements, be sure you keeps a very good decide to pay off the balance easily to avoid racking up too-much focus charge.

Think before you could obtain otherwise fool around with people device. Do you absolutely need the cash? As they are you deciding on the the very least costly option available to choose from?

FAQ: 401(k) loan against HELOC

A great 401(k) mortgage is a type of financing that enables that obtain out of your advancing years deals in your 401(k) account. The total amount you could borrow is generally restricted to this new minimal from $50,000 otherwise fifty% of your own vested account balance. That it loan should be repaid, have a tendency to through payroll deductions, in this five years, which have attention the past into the membership.

Property Guarantee Credit line, or HELOC, is a type of mortgage which allows homeowners so you can borrow secured on brand new guarantee he’s got collected in their home. That it guarantee depends upon industry property value your house minus your balance into the mortgage. An excellent HELOC often has actually a varying interest and certainly will getting used for one mission.