The greater the newest guarantee at your home, the fresh new less likely a debtor is always to walk off of it while in the times of economic filter systems. A lender will see the fresh new debtor once the a reduced amount of a danger when they lay a lot of cash into the buy upfront.

Has high bucks reserves

And a giant down-payment, that have many cash in an emergency financing suggests lenders one to even in the event your online business requires an effective nosedive, you’ll be able to store and come up with their monthly homes costs. Bolster your own offers therefore you are set to security assets taxation, home insurance, and you will one maintenance and you may repairs that can come right up.

Pay back personal debt

The fresh less month-to-month obligations money you have got entering the care about-functioning financial procedure, the easier it would be on precisely how to build your mortgage repayments.

Offer records

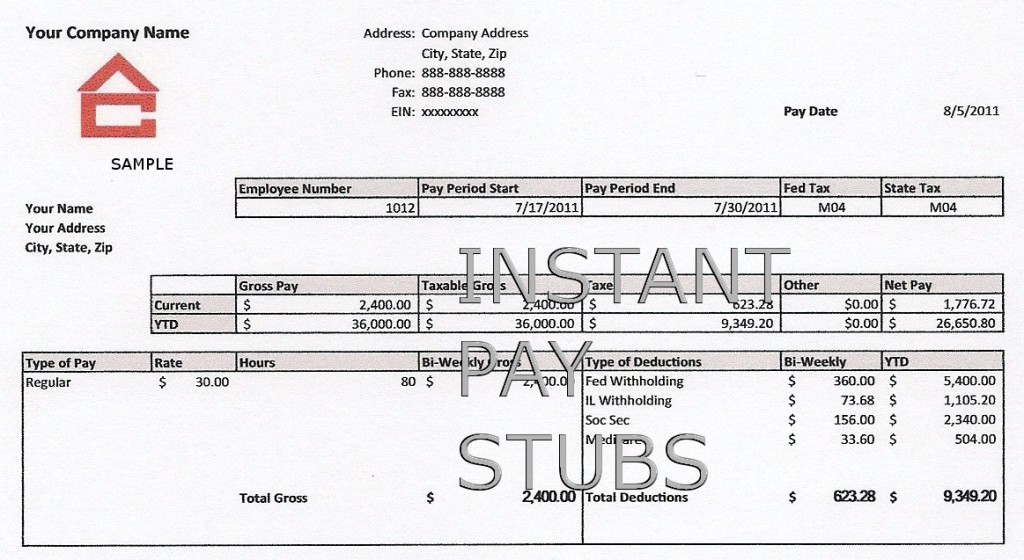

Are willing and ready to fully file your income as a result of earlier years’ taxation statements, profit and americash loans Notasulga loss comments, equilibrium sheets, and you will financial statements boost your likelihood of qualifying for a home-functioning home loan and having more advantageous prices. Your own lender can also require some or the following:

- Variety of expenses and you can monthly obligations for your business

- A number of assets (offers levels, capital account, etc.)

- Additional resources of income (alimony, Public Security, etc.)

- Proof of your online business otherwise mind-employed standing (providers licenses, letters regarding clients, statements out of your accountant, an such like.)

- Proof of most recent book or home loan repayments

Self-Functioning Financial Possibilities

If you’re mind-functioning plus don’t qualify for a normal mortgage, certain lenders nevertheless promote money that could be a match. Conventional mortgages aren’t guaranteed from the authorities, so they really routinely have stricter financing criteria. Here are some other options getting a self-functioning financial:

FHA mortgage

A federal Construction Management (FHA) mortgage is a mortgage that’s insured by Government Casing Management (FHA) and you may granted because of the a keen FHA-approved lender. FHA loans can handle lower-to-moderate-earnings consumers. Needed a lower minimal downpayment-as low as 3.5%-and lower fico scores than just of many traditional financing.

As FHA funds is federally insured-which means lenders is actually safe if the good debtor non-payments on their financial-FHA lenders could offer alot more good conditions so you can individuals just who might perhaps not otherwise qualify for home financing, along with lower rates. This means it is also more straightforward to be eligible for an enthusiastic FHA mortgage compared to a traditional mortgage.

Know that FHA loans carry out have companion costs, plus an enormous upfront home loan premium, so keep this as a back-up choice if you cannot get approved to own a traditional notice-working home loan.

Bank statement loan

Financial declaration fund, labeled as choice document fund, ensure it is borrowers to try to get that loan in the place of submission the conventional data files one to show income, such as for instance tax returns and you may W-2s. Rather, lenders take a look at twelve so you can a couple of years of one’s financial comments to check on your online business earnings.

Shared financial

Bringing a joint financial with an excellent co-borrower who is an excellent W-2 worker, eg a significant other, spouse, otherwise top friend who’ll show possession of your home, is yet another cure for change your applicants of going acknowledged getting a mortgage while self-operating. Good co-borrower brings even more warranty with the lender that there surely is a steady income to blow right back your debt. However, your co-debtor might you would like good credit and you will a reduced-to-average loans-to-income proportion so you’re able to be considered with you.

Register a great co-signer

Finally, a grandfather or any other relative will be happy to co-signal the mortgage. Just remember that , this person will need to be willing and ready to imagine full responsibility into financing for folks who standard. That’s a great deal to ask.