The house review should be done of the good NACA acknowledged house and you can insect inspector, and once over, this new inspector delivers the newest report to NACA getting opinion. At that point, i received a listing of requisite repairs which had become handled to choose the domestic through the NACA.

This course of action would be difficult. Why NACA is so strict is because they need to ensure that the customer isn’t going to move into property with many problems that they throws the consumer on monetary danger.

The strict NACA domestic purchase requirements falls under how come one to particular Realtors commonly chat a seller aside recognizing an offer regarding a potential visitors playing with NACA, which almost took place so you’re able to united states. Nicole knew the new questions and you will were able to address that it myself towards seller’s Realtor. That it compensated this lady anxiety and you may she while the supplier accessible to run us.

I worked with the Agent to choose and that solutions we may target and you may and that fixes we wanted to ask owner so you can address. A buyer gets the solution to pay money for solutions of wallet otherwise potentially link the price within their home loan. Once more, I can not overstress the necessity of coping with an event Agent. Nicole stored the offer.

Confirming you are still licensed

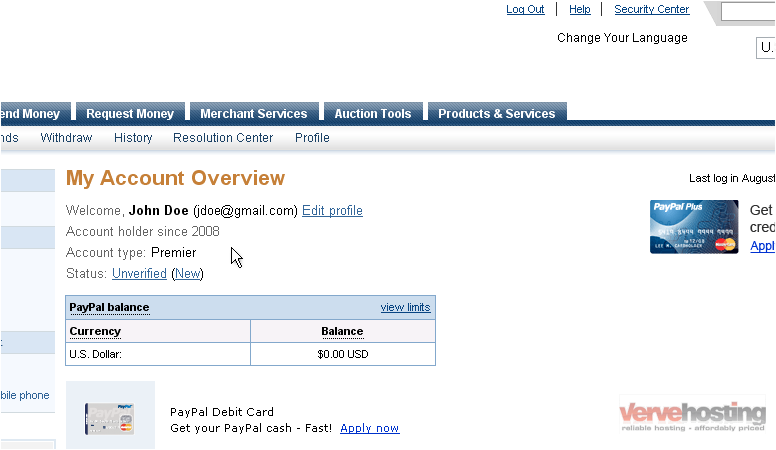

As we was acknowledged in order to gone forward following the examination, we’d to be recognized to possess NACA credit availableness, hence affirmed that people were still NACA qualified. (performed We talk about the brand new a lot of documents?) When we was accepted, we accomplished the latest NACA loan application. This process ran most quickly for people when you look at the higher section of the new upfront performs we did:

- We structured all the necessary recommendations inside the Google Docs ahead of date

- We made certain that we stayed NACA licensed regarding procedure

- We produced a place to learn the way all of our housing counselor wished to discovered suggestions

- We kept our very own data files upwards-to-day toward newest account and you will spend pointers

- I rapidly provided people requested files

- We obtained an enthusiastic efax amount to transmit data which had to end up being faxed

- And you will once more, we had an experienced Agent.

Handling new closure dining table

Finally, our very own file was relocated to a closing coordinator. We immediately called her and you can requested the lady an identical correspondence preferences I inquired the new MC. She is extremely effective. Up to now the vendor got done the fresh new repairs he had accessible to in addition to household inspector re-checked our home.

I also was required to select a builder towards solutions i was indeed expected to enhance. To speed up the process, I choose a number of contractors on NACA recognized checklist and you may luckily for us, they may bring estimates to your called for works rapidly. Indeed, mainly because designers knew the fresh new NACA procedure and you can had been brief with its solutions, we obtained all of our Obvious to close off just before agenda!

Immediately after closure

During the closing, we found out about new NACA Post Closure System, which offers free complete counseling, in addition to financial and you may credit suggestions, short-label financial help to aid pay the mortgage and even guidance having that loan amendment if needed. This was nice understand they really carry out have to help build high neighborhoods!

Worth it in the long run

The process is much time and you may difficult, but for me personally it had been worth it finally. I were left with a good 15 seasons financial which have an enthusiastic .65% interest you to easily fit into our very own funds. (no, that quantitative isnt out-of-place our rate of interest is actually less than step 1%)

Whenever you are in search of carrying out financing with NACA, you’ll want a number of freedom into go out we would like to become a citizen, enough organizational event to help you balance the procedure, and you will patience to not ever shout while are requested so you can outline a document a different big date. Chocolate is an informed coping mechanism for me personally. When you can make it through the method, it’s a great deal.